SoFi Active Investing might be for you if: You want an easy-to-use app with a wide range of zero-commission investments. With SoFi, you can invest in everything from stocks to mutual funds to fractional shares to IPOs. SoFi Active Investing will even match your eligible IRA rollovers and contributions with an extra 1%.

In this SoFi Active Investing review, you'll learn more to see if this brokerage is for you.

This brokerage is a clear standout for its well-rated mobile app and 1% IRA match on rollovers and contributions. It also has unique investment offerings like IPOs, options, and fractional shares.

$0 for stocks, $0 for options contracts

$0

Get up to $1,000 in stock when you fund a new Active Invest account.

On SoFi Active Investing's Secure Website.

Alternatives to Consider

We recommend comparing brokerage options to ensure the account you're selecting is the best fit for you. To make your search easier, here's a short list of our best trading platforms of 2024.

| Broker | Best For | Commissions | Learn More |

|---|---|---|---|

Rating image, 4.5 out of 5 stars.

4.5/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Managing your finances under one roof | $0 for stocks, $0 for options contracts |

Learn More for SoFi Active Investing

On SoFi Active Investing's Secure Website. |

Rating image, 4.5 out of 5 stars.

4.5/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Low fees on stocks, ETFs, crypto, and options | $0 for stocks, ETFs, and options; up to $6.99 monthly for Robinhood Gold |

Learn More for Robinhood

On Robinhood's Secure Website. |

Rating image, 4.5 out of 5 stars.

4.5/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Charts, research, and data analysis | Commission-free; other fees apply |

Learn More for E*TRADE

On E*TRADE's Secure Website. |

Full SoFi Active Investing review

SoFi Active Investing ranks as one of Motley Fool Money's top picks for best brokerages. This investment platform makes it easy to buy a wide range of stocks, ETFs, and other investment offerings.

Unlike many brokers, SoFi Active Investing offers mutual funds, IPOs, options, and alternative funds like commodities and private credit. And you can get other financial products from SoFi, like high-yield bank accounts and credit cards.

SoFi Active Investing has a lot to offer for any investor who wants an easier way to manage their everyday money and invest for the future.

Here's what the desktop interface looks like:

And here's what the app interface looks like:

Our brokerage rating methodology

At Motley Fool Money, brokerages are rated on a scale of one to five stars. We primarily focus on fees, available assets, and user experience; however, we also take into account features like research, education, tax-loss harvesting, and customer service. Our highest-rated brokerages generally include low fees, a diverse range of assets and account types, and useful platform features.

See our full methodology here: Ratings Methodology

My investing experience

I have been investing for about 20 years, and I believe in the value of low-cost, diversified, long-term passive investing in ETFs and mutual funds. I like brokerages that offer a wide range of investment choices while keeping costs low. I want features that make investing more accessible with a modern, user-friendly approach. And if a brokerage can offer high APYs on uninvested cash, that's a nice extra bonus!

We tried it: Our team's experience

Here at Motley Fool Money, we pride ourselves as real users of most of the products across our site. Writer Brittney Myers uses SoFi Active Investing -- here's her take on this broker:

Selection of investments

SoFi Active Investing offers a surprising variety of securities and investment products in which I can invest my money. This includes all the typical products:

- Stocks

- Options

- Bonds

- ETFs

- Mutual funds

- Cryptocurrency

I like that I don't have to buy full shares, which can be pricey for some companies. Instead, I can choose to invest a set dollar amount with fractional shares.

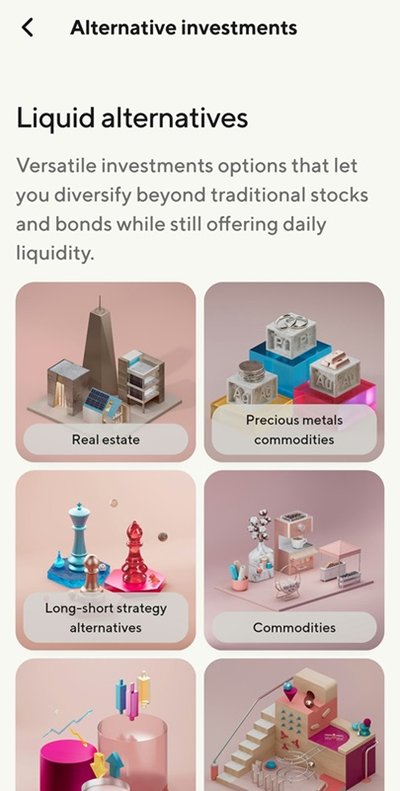

I'm also interested in SoFi's new array of "alternative investments." This includes options like real estate, precious metals, and commodities, which can help diversify my portfolio.

Making a trade

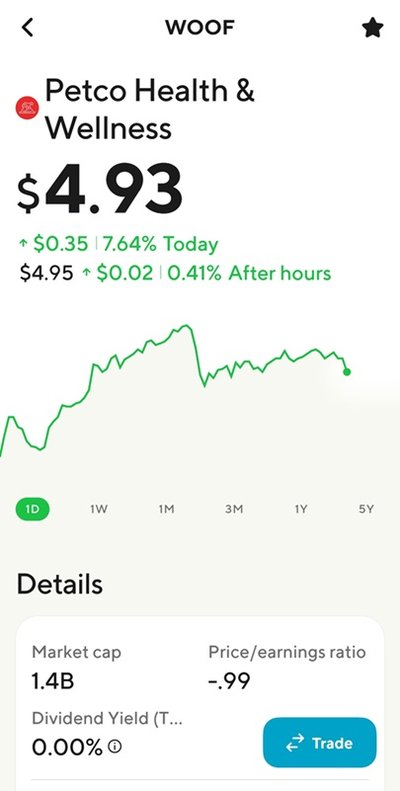

I appreciate that SoFi makes it very simple to get to my trade options from pretty much anywhere via the blue Trade button. It's especially convenient when I'm on the info page for a specific stock and am ready to make the purchase.

It's simple to set up my trades. I can do it in a few easy steps:

- Tap the Trade button

- Choose a one-time or recurring trade

- Decide whether to buy in dollars or shares

- Choose my amounts

- Review and initiate my trade

Checking the status of my trades is easy, too. My investing dashboard includes a snapshot of my recent activity, so I can see all of the trades I've completed and what's still in the works.

Learning about investing

I'm far from an investing expert, and there are definitely still times when I need a little more information to help me make the right investing choices. I like that SoFi includes several robust guides on a lot of the foundational topics that can impact your investing success.

For example, I know a little bit about dividends, but the ins and outs of how and when they pay out? That required a bit of extra reading.

Even if you're pretty knowledgeable about investing, refamiliarizing yourself with the basics can help you stay on top of your skills and not forget important fundamentals.

Brittney's final thoughts: SoFi Active Investing is a simple introduction to investing

SoFi could be worth a try if:

- You're new to investing and want educational resources.

- You want to explore a variety of investment types.

- You like a simple, easy-to-use interface.

If this sounds like what you're after, then SoFi could be the right investing app for you.

Folks who have more investing experience and need more tools and data may want to look elsewhere. This app isn't as feature-rich as others out there.

Investment offerings

SoFi Active Investing gives you access to an impressive range of investment offerings. Whether you want to buy individual stocks or fractional shares, get simple diversification with ETFs and mutual funds, or pursue more complex investment strategies with options and alternative investments, SoFi Active Investing makes it all possible.

Investments

- Alternative investments

- ETFs

- Fractional shares

- IPOs

- Margin investing

- Mutual funds

- Options

- Stocks

Brokerage accounts

- Rollover IRA

- Roth IRA

- SEP IRA

- Taxable brokerage

- Traditional IRA

TIP

As part of the overall SoFi platform, SoFi Active Investing customers can also access other financial services. SoFi also offers:

- Banking

- Credit cards

- Insurance

- Mortgages

- Personal loans

- Robo-advisor (via SoFi Automated Investing)

Commissions and fees

Like most online brokerages, SoFi Active Investing charges (mostly) no fees and no commissions. But you will have to pay a 0.5% purchase fee for alternative investment funds.

| Reason | Cost |

|---|---|

| Alternative investment funds | 0.5% purchase fee |

| ETFs | $0 |

| Mutual funds | $0 |

| Options | $0 |

| Stocks | $0 |

The only commission that SoFi Active Investing charges is a 0.5% purchase fee for alternative investments like private credit, real estate, and pre-IPO companies. Although SoFi Active Investing has $0 commissions on options, it does charge a $5 fee for option exercise and assignment. The SoFi Active Investing platform also charges some miscellaneous regulatory fees that are typical of any brokerage.

Margin rates

As of July 3, 2024, SoFi Active Investing is charging a standard margin rate of 12%. This is in line with what most other brokers offer for margin loans. Keep in mind that margin rates can change at any time based on SoFi's sole discretion.

Margin investing can be risky and can expose you to even larger risks of loss than the usual ways of investing. Be aware of the possible financial downsides before you buy stocks or other potentially risky investments with margin loans.

Research and education

SoFi Active Investing is designed to be a simple, easy-to-use investing platform that is primarily targeted at beginning investors. While SoFi Active Investing offers real-time investing news, stock quotes, and educational content, it does not offer access to third-party stock research at this time.

However, not everyone needs third-party stock research to make good investment decisions. The investor education content that SoFi offers could be valuable to many people. Here are some recent examples:

- What are alternative investments?

- Investing for beginners: Ways to get started

- What is an IRA and how does it work?

- Call vs. put options: What's the difference?

- 401(k) vesting: What does vested balance mean?

Investors who want more professional-grade investment research, or who like to analyze stocks with advanced charting tools and other sophisticated capabilities, might prefer a full-featured brokerage.

Interface

SoFi Active Investing offers a clean, modern interface with a surprisingly broad range of investment options. It isn't intended to be the best place for experienced investors who are analyzing stocks. If you want more sophisticated trading tools and professional investment research, SoFi is not the right platform for you.

But if you want a simple, easy-to-use platform, SoFi Active Investing gives you access to thousands of mutual funds, ETFs, options, stocks, and even IPOs and alternative investment funds that historically have been available only to high-net-worth investors. SoFi Active Investing can be a great place to start (or expand) your journey as an investor.

Another advantage of the SoFi Active Investing interface is that it's easy to get access to other financial products from SoFi. SoFi can be an all-in-one platform to help you manage all your money in one place -- from investments to banking and more. SoFi also offers one of our top-rated robo-advisors, SoFi Automated Investing.

App

Investors can buy and sell stocks, ETFs, and other investment types through the SoFi Active Investing desktop platform. They can also use the highly rated SoFi Banking and Investing mobile app, which also serves as the home base for all of SoFi's financial products.

Here are a few ways you can use the SoFi app to invest:

- Invest in ETFs, stocks, and more

- Buy fractional shares for as little as $5

- Trade options with no commissions

- Invest in IPOs

- Manage your retirement accounts (traditional IRA, Roth IRA, or SEP IRA)

The SoFi app is known for its ease of use and gets excellent ratings for iOS, and slightly lower but still pretty good ratings for Android. The SoFi mobile app is currently rated at 4.8 stars out of 5 in the App Store, and 3.9 stars out of 5 in Google Play. (Most of the financial companies we review tend to get lower ratings for their Android apps than for iOS.)

Customer service

SoFi gets mixed reviews from the Better Business Bureau. According to BBB.org, SoFi has an A+ rating, but is not accredited by the BBB. And its customer ratings are negative, with 1.53 stars out of 5. SoFi has closed 960 complaints in the past 12 months on BBB.org, but these complaints include all of SoFi's financial services, like banking and personal loans, not just SoFi Active Investing.

The reviews are much more favorable on Trustpilot, where SoFi gets 4.6 stars out of 5. There are a few complaints from SoFi investment customers. One customer complained about how long it took for newly deposited funds to be available to invest, and another complained about SoFi "freezing stocks."

However, there are also many comments on Trustpilot from SoFi customers who said using this brokerage for investing has been a great experience. But in case you need help with your SoFi Active Investing account, there are several ways to contact SoFi customer service:

- 24/7 online chat with intelligent virtual assistant

- Phone line open Monday–Friday from 5 a.m.–5 p.m. PT at 855-525-SOFI (7634)

- In-person locations in San Francisco, New York, and Healdsburg, California

- X.com: @SoFiSupport

Security

SoFi uses industry-standard security protocols and safeguards to protect your account. These include third-party reviews of its security controls and systems in accordance with security standards, including PCI DSS and SSAE 18 SOC2. SoFi also goes through third-party penetration testing at least once per year.

In case your password is suspected of being compromised, SoFi will require you to reset your password at the next login. You can also protect your account with two-factor authentication (2FA) via the online SoFi platform.

About

SoFi is a one-stop, member-centric platform for digital financial services -- spending, saving, investing, and more. The company was founded in 2011 as Social Finance, Inc. Along with its personal loans and banking offerings, SoFi launched SoFi Invest® in January 2019. Today, SoFi has more than 8 million members.

Learn more about SoFi Active Investing

Keep reading about SoFi Active Investing on these pages:

-

Review sources

- https://www.sofi.com/invest/alternative-investments/

- https://www.sofi.com/invest/active/

- https://www.sofi.com/invest/retirement-accounts/

- https://www.sofi.com

- https://www.sofi.com/wealth/assets/documents/sofi-invest-fee-schedule.pdf

- https://investors.sofi.com/news/news-details/2024/SoFi-Breaks-Down-Barriers-to-Investing-By-Offering-Alternative-Investments/default.aspx

- https://www.sofi.com/learn/content/investing/

- https://apps.apple.com/us/app/sofi-banking-and-investing/id1191985736

- https://play.google.com/store/apps/details?id=com.sofi.mobile&hl=en_US

- https://www.bbb.org/us/ca/san-francisco/profile/loans/sofi-1116-439036

- https://www.bbb.org/us/ca/san-francisco/profile/loans/sofi-1116-439036/complaints

- https://www.trustpilot.com/review/sofi.com?search=investing

- https://www.sofi.com/our-story/

- https://www.sofi.com/contact-us/

- https://x.com/sofisupport

- https://support.sofi.com/hc/en-us/articles/360044101491-How-is-SoFi-working-to-keep-my-information-safe

- https://support.sofi.com/hc/en-us/articles/360048825291-Does-SoFi-support-two-factor-authentication-2FA-apps

FAQs

-

SoFi Active Investing is the financial service company's brokerage offering. It allows SoFi® Invest customers to buy and sell stocks, ETFs, mutual funds, and options through an easy-to-use platform, and can be used through the same mobile app and web platform as SoFi's bank accounts and loan products.

-

SoFi Active Investing is designed to be a user-friendly way to buy stocks and other investments for investors of all experience levels. It has an easy-to-use platform and a ton of educational resources to help newer investors learn.

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Motley Fool Money does not cover all offers on the market. Motley Fool Money is 100% owned and operated by The Motley Fool. Our knowledgeable team of personal finance editors and analysts are employed by The Motley Fool and held to the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.

Robinhood disclosure

All investments involve risk and loss of principal is possible.

Securities are offered through Robinhood Financial LLC, member FINRA/SIPC. Cryptocurrency services are offered through an account with Robinhood Crypto, LLC (NMLS ID 1702840). Robinhood Crypto is licensed to engage in virtual currency business activity by the New York State Department of Financial Services. Cryptocurrency held through Robinhood Crypto is not FDIC insured or SIPC protected. For more information see the Robinhood Crypto Risk Disclosure.

Trades of stocks, ETFs and options are commission-free at Robinhood Financial LLC. Other fees may apply. Please see Robinhood Financial’s Fee Schedule to learn more.

Fractional shares are illiquid outside of Robinhood and are not transferable. Not all securities available through Robinhood are eligible for fractional share orders. For a complete explanation of conditions, restrictions and limitations associated with fractional shares, see the Fractional Shares section of our Customer Agreement.

Robinhood Gold is an account offering premium services available for a $5 monthly fee. Not all investors will be eligible to trade on Margin. Margin investing involves the risk of greater investment losses. Additional interest charges may apply depending on the amount of margin used. Bigger Instant Deposits are only available if your Instant Deposits status is in good standing.

Investing is risky. Bonus offers subject to terms and conditions, visit robinhood.com/hoodweek for more information. Margin is not suitable for all investors. Robinhood Gold is offered through Robinhood Gold LLC and is a subscription offering services for a fee. Brokerage services offered through Robinhood Financial LLC (member SIPC), a registered broker dealer.

E*TRADE services are available just to U.S. residents.