Short interest is an important concept for investors to understand since it can be a driving force behind market movements. For example, the notable GameStop (GME 2.96%) spike a few years ago wouldn't have been possible if the stock didn't have a high short interest.

With that in mind, here's a breakdown of short interest, a few examples of stocks with high short interest, and why it's so important for investors to know about short interest.

Overview

What is short interest?

Short interest is the amount, or percentage, of a certain company's stock that is currently sold short. It is based on the company's float, which is the number of shares that are available for trading, and excludes things like insider stakes and restricted stock.

For example, if a company has 10 million shares of stock available to trade, and traders have 1 million shares currently sold short, it would have a short interest of 10%.

A high level of short interest in a stock is an indicator of bearish, or negative, sentiment by investors. Investors sell stocks short when they believe stock prices are likely to go down. And while there are always some people who are short any given stock at any given time, a high level of short interest indicates a widespread negative outlook.

What is a high level?

What is a high level of short interest?

There's no set percentage that is a specific definition of a high short interest since it depends on several factors, such as the general economic and stock market sentiment at the time. Having said that, many investors consider a high level of short interest to be anything greater than 10% of the float.

Other investors often base their definitions of high short interest on a concept known as "days to cover," which is the number of shares sold short relative to the stock's average daily volume. In theory, this is how long it would take for all of the short sellers to cover their short sales in a normal climate.

Short squeeze

High short interest can fuel a short squeeze

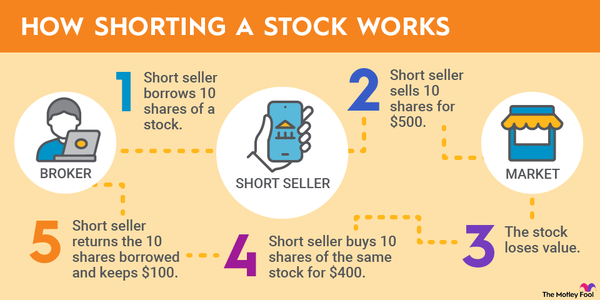

Another important concept related to short interest is known as a short squeeze. The general idea is that if many investors have sold a stock short, and too many people try to cover their short sales at the same time, it can drive the price higher and higher. And while this obviously isn't a very technical explanation, here's the basic process of a short squeeze.

- A certain stock has a high short interest due to many investors thinking the price will go down.

- Something happens that changes investor sentiment. This could be a strong earnings report, a management change, or any number of other factors.

- Some short sellers rush to buy shares to cover their positions. This creates demand for the stock and drives the price higher.

- The higher share price makes other short sellers panic and rush to cover, driving the price up even further.

This can last a long time and lead to a massive spike in a stock's price, as we saw with GameStop a few years ago.

Related investing topics

Examples

Examples of stocks with high short interest

As mentioned, there's no set-in-stone definition of high short interest. But just to name a few real-world examples, here are a few publicly traded stocks that had some of the highest levels of short interest in August 2024: