In a world often dominated by consumption and social media posts glorifying said consumption, "stealth wealth" stands out as a practice of understated affluence. Stealth wealth is about living below your means despite having significant wealth.

The concept resonates with many who seek financial security without the trappings of a lavish lifestyle or the unwanted attention from hangers-on and the IRS. But what exactly is stealth wealth, why is it important, and how can you adopt this approach?

What is it?

What is stealth wealth?

Stealth wealth is the practice of keeping one's financial status under wraps. Individuals who subscribe to this philosophy typically avoid flashy displays of wealth.

They might drive modest cars, live in average homes, and generally blend into their surroundings despite the ability to indulge in luxury. The essence of stealth wealth lies in the belief that true financial security comes from being prudent and discreet about one's wealth, enabling many to avoid its pitfalls and trappings.

Embracing it

Why you should consider embracing stealth wealth

There are several reasons people embrace the stealth wealth lifestyle.

Protection from unwanted attention

A primary reason people adopt stealth wealth is to protect themselves from unwanted attention. When the IRS decides who is audited, ostentatious social media displays of wealth that do not match a person's tax returns can raise a red flag.

Displaying wealth can also attract people who are after the wrong things. In some developing countries, displaying wealth can result in you being nabbed off the street and held for ransom.

Financial security and long-term planning

Stealth wealth encourages prudent financial management by motivating people to live below their means rather than beyond them. By avoiding the temptation to spend excessively, individuals can focus on long-term financial goals, such as planning for retirement, investing in assets, and ensuring generational wealth. This approach fosters a mindset of saving and investing rather than spending, which is crucial for sustained financial security.

Psychological benefits

Living a life of stealth wealth can also have significant psychological benefits. It can reduce the stress associated with maintaining a luxurious lifestyle and the constant pressure to keep up with the Joneses.

These days, millions flaunt wealth they might even have. For example, rather than splurging on a luxury meditation retreat in Costa Rica so you can post pictures on Meta's (META 2.1%) Instagram, why not channel your inner Siddhartha and try to attain nirvana by really meditating and avoiding societal pressure for status while relieving stress?

Steps to take

Adopting stealth wealth in your life

If you want to get into the stealth wealth lifestyle but are unsure which steps to take, here are some places to start:

Assess your current lifestyle

The first step is to assess your current lifestyle and spending habits. Do you go out on a Friday night, indulge in bottles of champagne with the requisite good-looking people in tow, and realize on Sunday that you spent way more than you can afford? If your current lifestyle revolves around heavy spending with no real tangible results or benefits, you might want to consider more of a stealth-wealth lifestyle.

Focus on financial goals

Redirect the money saved from reducing unnecessary expenses toward your financial goals. You might be surprised at how much sooner you can afford to buy a house with a stealth-wealth mentality. Remember, wealth that is stealth is still wealth -- and you can grow that wealth through smart investments.

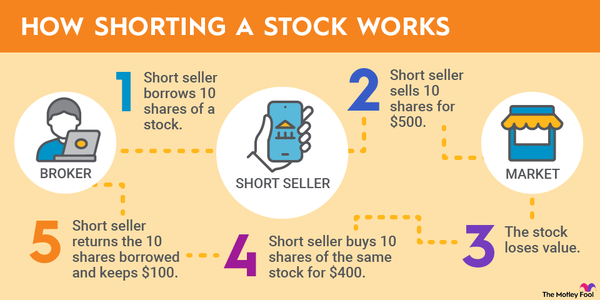

If you can continue your low-key, stealthy existence, you can become even wealthier. Whether building an emergency fund, investing in the stock market, or saving for a down payment on a property, having clear financial goals can help you stay focused and motivated. The key is to prioritize long-term security over short-term gratification.

Related investing topics

All-stars

The Motley Fool's stealth wealth all-stars

Let's be honest here: The true stealth wealthers' stealth will be so great that no one will know who they are. That said, here is our list of stealth wealth all-stars:

| Name | Industry | Reason for All-Star Selection |

|---|---|---|

| Amancio Ortega | Retail (Zara) | Maintains a low public profile despite massive wealth |

| David Cheriton | Technology | Known for his low-key lifestyle despite early investment in Alphabet's (NASDAQ:GOOG)(NASDAQ:GOOGL) Google |

| Chuck Feeney | Retail (Duty Free Shoppers Group) | Gave away most of his fortune anonymously through philanthropy |

| Ingvar Kamprad | Retail (IKEA) | Lived modestly and avoided the spotlight despite founding IKEA |

| Phil Knight | Sportswear (Nike) | Prefers privacy and a low profile despite Nike's (NYSE:NKE) global presence |

| Forrest Mars Jr. | Food (Mars Inc.) | Avoided publicity while growing Mars Inc. into a global giant |

| Jim Walton | Retail (Walmart) | Lives a private life focusing on community banking and Walmart (NYSE:WMT) |

| Laurene Powell Jobs | Investments (Emerson Collective) | Engages in quiet philanthropy and is not nearly as well known as her late husband |