A subsidiary is a company that is majority-owned by another company. The owning company, called a parent, can be a functional business selling its own products and services. It could also be a holding company whose primary purpose is owning other businesses.

Here, we'll review how subsidiaries operate and report their financial results. We'll also explore why parent companies choose the subsidiary structure over alternatives like mergers. We'll wrap up with a look at the subsidiary relationship between Walt Disney (DIS 0.88%) and sports network ESPN.

What are they?

Understanding subsidiaries

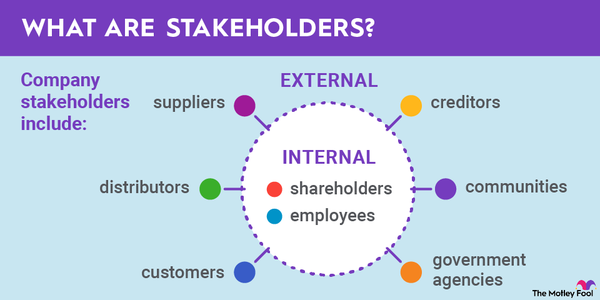

Subsidiaries are more than 50% owned by their parent but remain legally separate entities. Subsidiaries and parent companies have independent operations, governance, and reporting.

A parent company's equity stake in a subsidiary can range from just over 50% to 100%. When the stake is 100%, the subsidiary is known as a wholly owned subsidiary. If the equity position is between 20% and 50%, the company is an affiliate or associate, not a subsidiary.

Despite the legal separation between subsidiaries and their parents, overlap often exists in decision-making and finance. The parent usually holds most of the subsidiary's voting shares, giving it control over the board of directors and other decisions subject to shareholder voting. Additionally, the parent may guarantee the subsidiary's debt.

Financial reports

Subsidiary financial reporting

Subsidiaries create their own financial reports, and parents consolidate those results into their reporting. If the parent owns multiple subsidiaries, as Berkshire Hathaway (NYSE:BRK.A)(BRK.B 0.63%) does, the consolidated statements will include the results of all their majority-owned businesses. Parents may also voluntarily break out the results of one or several subsidiaries as supplemental information.

Associate or affiliate company results are not consolidated into the parent company's reporting. They are usually reported as equity investments on the parent company's balance sheet.

Why own them?

Why companies own subsidiaries

Companies invest in other businesses to share in profits, achieve cost or product synergies, or gain access to new markets, customers, or technologies. Cost synergies can occur when a company takes a majority ownership position in a key supplier. Product synergies become available when a parent buys a business with a related product or service.

The investment can be pursued in different ways, including:

- Buying a small percentage of public shares and holding them as investment assets: Berkshire Hathaway has many subsidiaries, but the holding company also has an enviable stock portfolio. That portfolio includes shares of Apple (AAPL 0.65%), Bank of America (BAC 1.33%), Coca-Cola (KO 0.4%), and others. This is reported as a balance sheet asset.

- Buying a larger equity stake that isn't a majority position: The owned company is an affiliate or associate reported as an investment by the parent.

- Buying a majority share: The majority position creates the subsidiary structure in which the parent reports consolidated results that include the owner and subsidiary.

- Merging: A company can combine with another company to create a new business that has one leadership team and reports one set of financial statements.

Of these options, the subsidiary relationship provides the most balanced blend of influence and protection for the parent. A majority owner deeply influences the subsidiary's leadership team and decision-making. However, because the subsidiary remains legally independent, the owner is also insulated from the subsidiary's losses and legal issues. Mergers do not provide this separation of risk.

Buying a subsidiary is also easier, faster, and cheaper than a merger.

Disney and ESPN

Disney and ESPN

Disney acquired the ABC television network in 1996. ABC, in turn, owns 80% of ESPN. Media company Hearst Corporation owns the remaining 20%.

ESPN operates separately from Disney with its own leadership team headed by CEO Jimmy Pitaro. However, Disney reports consolidated financial statements that include ESPN results. Disney also breaks out key ESPN metrics and shares the sports network's strategic highlights in its own earnings calls.

Related investing topics

For the quarter ending March 30, 2024, Disney reported ESPN revenue of $4.2 billion and operating income of $799 million. Disney also announced that ESPN will launch a standalone streaming channel in 2025. Disney currently offers ESPN+ within a bundled streaming package that also includes Hulu and Disney+. The new standalone ESPN is expected to be part of the Disney+ bundle.

Although subsidiaries are legally separate from their parent companies, they often collaborate. The use of ESPN programming within Disney-branded services is an example of product collaboration and synergy between parent and subsidiary.