Did you know that Americans typically retire before the age of 65? But what's surprising is that it isn't because their finances are in such good shape that they can afford to do so.

The median retirement age is 62, and the main reason retirees stop working early is that they have to. Health issues, a disability, and factors outside their control are the main reasons Americans retire early, according to a recent survey from the Employee Benefit Research Institute.

Ideally, people would be retiring early because they can afford to do so, not because they're forced due to factors they can't control and that may result in more stressful retirement years. One way you can put yourself in a stronger financial position and retire early because your finances allow for it is by investing your savings. And there are two exchange-traded funds (ETFs) that can help you with that: the Vanguard S&P 500 ETF (VOO 1.20%) and the Vanguard Total Stock Market Index Fund ETF (VTI 1.27%).

1. Vanguard S&P 500 ETF

A fund that mirrors the S&P 500 (^GSPC 1.23%) can be a great investment, since it will give you exposure to the best stocks on the market, including Apple and Microsoft. And the Vanguard S&P 500 ETF has a light expense ratio of 0.03%, which ensures that fees aren't eating up a big chunk of your gains. With a median market cap of more than $260 billion, you aren't taking on a big risk with volatile investments in this type of ETF, which is why it can be ideal for long-term investors who just want a fund to put money into on a regular basis.

VOO Total Return Level data by YCharts

Over the past decade, the fund has achieved total returns, including its dividend, of around 250%. That averages out to a compounded annual growth rate (CAGR) of 13.4%, which is higher than the S&P 500's long-run annual average of around 10%. In the long run, that rate may come down, especially with many growth stocks trading at elevated levels right now. However, with some excellent diversification and room for the fund to help you achieve significant long-term returns, this can make for a solid investment that can help you retire early.

2. Vanguard Total Stock Market Index Fund ETF

A more diverse fund to hold is the Vanguard Total Stock Market Index. It contains more than 3,600 stocks and also has a low expense ratio of 0.03%. By giving investors exposure to large-, mid-, and small-cap stocks, there's even less risk to individual stocks than with a fund that mirrors the S&P 500.

And so, if you're concerned that the S&P 500 may be a bit too expensive, you may find this ETF to be a more suitable option for you. You'll still get access to top stocks, but they won't account for as much of the fund's overall weight.

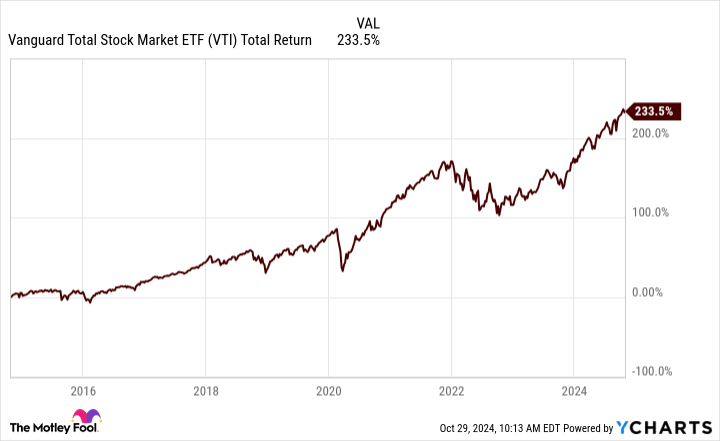

The broader diversification means you may be sacrificing some stronger gains (in bullish years) in exchange for additional safety. But that doesn't mean the Total Stock Market ETF hasn't been a great fund to own. Over the past decade, its total returns of 234% aren't too far behind the Vanguard S&P 500 fund, with a CAGR of 12.8%.

VTI Total Return Level data by YCharts

Investing in the fund can provide you with an even simpler strategy in the long run, by knowing this passively managed ETF gives you exposure to more than just the big-name stocks. And with the fund being a bit more diverse, it may be less vulnerable if there's a sell-off in tech or highly valued growth stocks.

Either of these ETFs can be great investments to hold for the long term, as they can help you significantly grow your savings over time. You may want to consider putting money into both of them.